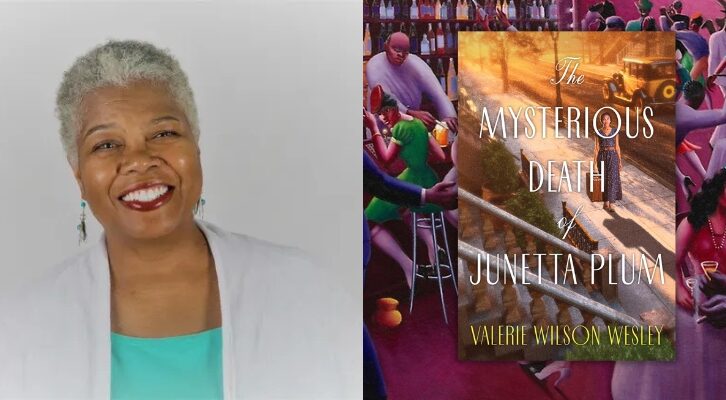

On the Small Family Firm Responsible for So Much American Economic Power

Zachary Karabell Traces the History of Brown Brothers Harriman

In the United States, the pursuit of profit was woven into the founding fabric, not as explicitly as the pursuit of happiness but there all the same. The Jeffersonian ideal was a nation of yeoman farmers guarding their freedoms and independence, but it was Alexander Hamilton’s financial system that ultimately defined the economy. Following the Revolutionary War and then the War of 1812, which sealed American independence, the United States began its ascent to become the world’s largest economy within little more than a century. How that happened has been a source of constant debate. Perhaps it was a function of a vastly fruitful continent, the lack of regional competition, the protection afforded by two oceans, the influx of immigrants who brought their own dreams and ambitions and then inscribed those on a new nation, or none of those or all of them. But perhaps the key lies in one of Alexis de Tocqueville’s many piercing observations: “I know of no other country where love of money has such a grip on men’s hearts.”

One of the prerequisites for rapid economic growth is capital. Land, property and labor are all vital, but none are liquid. For much of human history, wealth locked up in land and property was rarely turned into productive capital to fund businesses or ideas. That began to change in the 19th century, and the United States was ground zero for the shift. Money, especially in the form of paper promises, was a fuel. In the United States, making money and putting it in motion came easily, often too easily. Money flooded markets, and then receded. It unlocked potential, and then unleashed havoc. Unburdened by an entrenched aristocracy of land or church, and with the Jeffersonian ideal of yeoman farmers shunted aside in favor of a Hamiltonian economy, 19th-century America became a land of money.

Until the Civil War, it wasn’t federal money. There were coins minted by the federal government, but those floated in a sea of paper promises issued by different banks and merchant firms such as Brown Brothers. Coins mattered, but paper was everywhere. It was a bewildering mix, kaleidoscopic and constantly changing. There is always a tension between order and chaos, and it is hard to find the right balance between just enough chaos to nurture innovation and enough order to keep everything from unwinding. Hence the sharp and constant economic crises of the 19th century. But that roiling, unsettling and harmful though it could be, was outweighed by the advantages. If you had a good idea in America, you had a better chance than anywhere in the world of finding money to fund it. Capital rarely flowed evenly; the 1870s and 1880s were flush with capital for the railroads but not so much for the working class or the farmers. Throughout the 19th century, there was paper money and credit, but there was also gold and silver, land and labor. The United States was fluid compared with the Old World, but it was easier to lose a fortune or never make one than to ascend the heights.

Brown Brothers acted as a conduit. From early in the 19th century, it became one of the primary channels through which money flowed. And flow it did, to merchants and their ships, to cotton plantations and to railroads and new farms and new towns and new businesses in the sprawling vastness of the continent. Brown Brothers facilitated that trade, first between Liverpool and Baltimore, and then once off-loaded by stevedores onto wagons, from Baltimore to the Ohio Valley. It funded, with offices in England and the Americas, successive generations of ocean-crossing vessels, some of which it owned outright, and for a brief moment, the house had a monopoly on the shipment of the Royal Mail from England to the United States. The Browns spurred the birth of transatlantic steamships and underwrote the Collins Line, which might have surpassed Cunard had it not been for a tragic accident. They created the first railroad, the one we all know from games of Monopoly, the Baltimore & Ohio line, the B&O. They expanded to Philadelphia and to New York, and their reach grew. They were financial innovators and one of the largest cotton merchants in the world. So influential was Brown Brothers by the mid-19th century that when the thunderous celebrity preacher Henry Ward Beecher wanted to make a point from his pulpit in Brooklyn, he constructed an entire sermon lambasting his congregants for placing more faith in letters of credit issued by Brown Brothers than they did in God.

Brown Brothers acted as a conduit. From early in the 19th century, it became one of the primary channels through which money flowed.

Brown Brothers was, in short, woven into the economic fabric of 19th-century America, its transportation network and its trade, with the cotton South and the agrarian West, with England and by extension with the rest of the world. It provided the credit that was more trusted than the notes issued by governments or the promises printed with abandon by the wildcat banks that dotted the American frontier. Paper issued by the House of Brown was essential to commerce, and without trusted paper, trade at the scale and scope required would have been impossible. The Browns determined exchange rates, and they provided travelers with letters to use abroad, which was a necessary prerequisite to a more interconnected world. Wherever American commerce flowed, Brown Brothers was there to keep it flowing. It didn’t just make money for itself; it made money for America. And without money, there would be no rise of the United States as a global power.

In the 19th century, the economic ambitions of the United States focused primarily on conquering the continent. But the conservative qualities that allowed Brown Brothers to thrive and survive in the first half of the century kept them largely on the sidelines of the investment craze of the second half of the 19th century: the railroads. Alexander Brown and his sons had helped create the first American railroad in the 1830s, but they largely eschewed the railroad boom in the decades after the 1860s. Fortunes were there to be made, but most of the railroads went bust, leaving their investors with worthless stocks. The innate caution of Brown Brothers prevented them from reaching the heights of J.P. Morgan, but it almost certainly protected them from being deluged by waves of bankruptcies and failures. Then the Great Depression hit.

The merger of Brown Brothers and Harriman blended two distinct cultures born of different paths to success. In the late 19th century, the lasting money was usually made by those who picked up the pieces after the initial railroad investors had lost everything, which was how E. H. Harriman built his empire. He was, in the 1890s, the nouveau riche, crass and aggressive, a rough and tough bundle of intensity. He courted attention where the partners of Brown Brothers avoided it. But while Edward Harriman and Alexander Brown could hardly have been more unalike, by the time Harriman’s fortune merged with the House of Brown in the 1930s, the world of his sons and of the next generations of Browns was more similar than not, nurtured by a small set of boarding schools and colleges that distilled the values of their fathers into a coherent, rigid web of money, duty and service that became the backbone of “the Establishment.”

The world this elite created after 1945 was not by design or intent. After the ravages of the Depression and a harrowing war, the United States found itself with immense relative power confronted by an adversary in the Soviet Union that was championing a system antithetical to its own. Whether the conflict of the Cold War was inevitable, Brown Brothers and the Establishment saw no other path. To meet the challenge, they distilled a formula to defend the world they knew and that they believed would serve everyone just as it had served them. The framework they erected unleashed the productive capital of the world, and established the foundation for the globalization of commerce and capital that so defined the rest of the twentieth century and the beginning of the 21st.

Having reached the apex of its influence in the years immediately following World War II, Brown Brothers, by the end of the 20th century, had faded in relevance. Its competitors, the firms of Goldman Sachs, J.P. Morgan, Morgan Stanley, and so many others, elected to go public in the 1980s, turning what had been skin-in-the-game partnerships into publicly traded entities relying on shareholder capital instead of their own. Those firms used that money. They accumulated almost unprecedented wealth, and they courted attention. That allowed them to outstrip Brown Brothers in size and scope, and, perhaps most critically, in greed and ambition. And then, in 2008, they almost destroyed the system they had made and that had made them.

Brown Brothers Harriman stayed out of that fray. Today the firm remains a large global financial institution with more than five thousand employees across the world. Its business has changed radically. It now acts as a custodian for trillions of dollars of global assets, a large amount of money that earns the firm relatively small but steady fees. Its culture revolves around service. In cleaving to the idea of a partnership, the company didn’t join the drunken capital party of the 1990s and 2000s and never rose so high that it could jeopardize the entire financial system. In that crucial sense, it stands as a reminder of what once was, and perhaps what all these banks should have remained. Mention the firm today, and many wonder if it still exists, if they wonder at all; others shake their heads and sigh as if to say, “How sad.” It is not at all. Given how close the global financial system came to the abyss in 2008‒9, and given that it was caused by the detachment of personal gain from public risk, the quiet continuance of Brown Brothers Harriman is a lesson for what capitalism can be. It provided the fuel, and it also set boundaries.

For sure, its particular ethos of service could mask a multitude of sins. Without question, it was self-serving and self-enriching, but more often than not it also served the needs of society at large. That was not without its own excesses. The firm was crucial to the cotton trade, and cotton depended on the labor of enslaved men and women. At the beginning of the twentieth century, Brown Brothers plunged into financing businesses and banks in Central America, indifferent to the disruptions that ensued, and then worked closely with the U.S. government to overthrow a government that threatened its investments. That was the darker side of how money made the world.

We live in a time when we have all become acutely aware of the role of capital as the glue binding our economy and as tinder that can cause it to implode. Spread widely, it can be a ballast; spread too unevenly, it can open fissures. Money can create a nation; it can energize technology revolutions, from the steamships and the railroads to the internet and the smartphone. But it can also unleash greed and deluge industries and countries, causing shocks that can shake society to its core. It can spread wealth but also concentrate it. It is indifferent to inequality. Nonetheless, the American formula, a capitalism distilled in the mid-20th century composed of rules and laws designed by Americans and cemented by the dollar, has been the formula for the world, from a China governed by the Communist Party whose economy is capitalist to the core, to a Nigeria whose government may be corrupt but whose society is market driven, from Scandinavian countries whose social contract flirts with socialism to authoritarian regimes in the Middle East that suppress expression but court investment.

Fiat money and the dollar are the bedrock of the global system, and Brown Brothers is part of the underwritten history of how that world came to be. Money is the power contained in the atom, which is why having people who believe their role is to serve the greater good and consider themselves stewards is a necessary prerequisite for a stable society. The Hippocratic oath does not guarantee that doctors will do good, but it tries to ensure that they knowingly do no harm. And in an age of pandemics and economic crises, Brown Brothers also demonstrates that being ever prepared for a storm is not just prudent; it is imperative.

The story of the Brown Brothers is the secret history of Wall Street. It is a story of sustainable capitalism. You might not like it if you object to capitalism, but you might want to emulate it to guard against capitalism’s inevitable excesses and imbalances. After the 1980s, their model of capitalism was superseded by more avaricious and ultimately more toxic variants, which is all the more reason to remember that other paths are possible. The partners of Brown Brothers have never wanted to be the story, and that reticence has made the firm’s centrality easy to overlook. But it is an underground river that flows through the American past, and its saga is a window into the crucial nexus of money, power and influence that made America. It is at times a heroic tale, sometimes prosaic and beneath the veneer of gentility, occasionally brutal and rapacious. But such is the history of America, of global capitalism and of any rise to power. Celebrated or reviled, it is necessary history, and in the case of Brown Brothers, one that has never been adequately understood. This is their story, and ours.

__________________________________

Excerpted from Inside Money: Brown Brothers Harriman and the American Way of Power by Zachary Karabell. Reprinted with permission of the publisher, Penguin Press. Copyright © 2021 by Zachary Karabell.

Zachary Karabell

Zachary Karabell was educated at Columbia, Oxford, and Harvard, where he received his PhD. He is a prolific commentator, both in print and on television, and the author of a dozen previous books, including The Last Campaign, which won the Chicago Tribune’s Heartland Prize, and The Leading Indicators. He is also a longtime investor, former financial services executive, and the founder of the Progress Network.