Carolin Benack and Sanjena Sathian on the Fiction of the Economy and the Dangerous Appeal of Excess

In Conversation with V.V. Ganeshananthan and Whitney Terrell

on Fiction/Non/Fiction

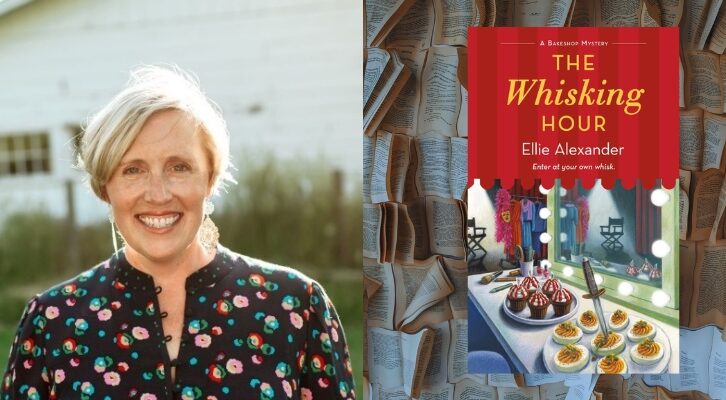

Scholar Carolin Benack and novelist Sanjena Sathian join co-hosts Whitney Terrell and V.V. Ganeshananthan to discuss how literature and economics intersect. First, Benack talks about the theoretical storytelling that is economics, and reads from her article on the topic. Then, Sathian reads from her debut novel Gold Diggers and talks about the American obsession with excess, and how our fluctuating economy impacts our relationship with wealth and reinvention.

To hear the full episode, subscribe to the Fiction/Non/Fiction podcast through iTunes, Google Play, Stitcher, Spotify, or your favorite podcast app (include the forward slashes when searching). You can also listen by streaming from the player above. And check out video excerpts from our interviews at Lit Hub’s Virtual Book Channel and Fiction/Non/Fiction’s YouTube Channel. This podcast is produced by Andrea Tudhope.

*

Selected readings:

Carolin Benack

Sanjena Sathian

Others

The Body Economic: Life, Death, and Sensation in Political Economy and the Victorian Novel by Catherine Gallagher • “The Economy of Pain: Capitalism, Humanitarianism, and the Realistic Novel,” by Wai Chee Dimock • U.S. Intelligence Report Warns of Global Consequences of Social Fragmentation, from The New York Times • All the King’s Men by Robert Penn Warren • The Great Gatsby by F. Scott Fitzgerald • Infinite Jest by David Foster Wallace • The Corrections by Jonathan Franzen • A Supposedly Fun Thing I’ll Never Do Again by David Foster Wallace • Rabbit Hole, podcast from the New York Times • George Saunders • Edith Wharton • John Updike

*

Part 1

With Carolin Benack

V.V. Ganeshananthan: So [in your article “Economists are more like storytellers than scientists—don’t let the Nobel for ‘economic sciences’ fool you”], you’re talking about economic models, like the concept of “perfect competition,” and you write, “Without the novel first teaching us how to deal with worlds that are not technically true but still believable, theoretical models might not exist in the way they do today.” I just love that idea of novels being technically not true, but believable. I’m not sure I’ve ever heard that definition, but it feels perfect to me. So how does it apply to economics?

Carolin Benack: First I want to say this is coming from Catherine Gallagher’s amazing work. She really shows how fiction in the early 18th century was conceived completely differently than it was later in the century. And that it really got people attuned to believing, for example, in paper money as a representation of gold. To the question of how this is applied in economics—I think, to some degree, you could say about any hypothesis that it is technically not true, but believable. Any kind of moment where you imagine something that you then want to construct a study out of requires that mechanism of fiction. What I think is interesting about economics is that this fictional mechanism is baked into their assumptions. So the story of opportunity cost, for example, that I talked about in the article is incredibly fundamental. When people talk about the rationality assumption, this is what they mean, this kind of decision making where you imagine someone who has to decide between different options.

VVG: And I feel like when we write, or when I talk to my students about writing, some of what you’re describing—I try to avoid the language of capitalism, but the language of choice, talking about how characters make decisions, is very much how I talk about stories. What are they giving up? And have they actually given anything up? Or even the way that people talk about futures. What are the futures I’m predicting here? What are the possible outcomes? Which is also the language of economics. I was very briefly someone who covered the economy, and I remember realizing that the economy was actually really interesting if you paid attention to it in this way. They, both fiction and the economy, have really specific relationships to time. The speed at which it moves forward, the way different bets are placed. This is such an interesting analogy to me. Although I’m certainly going to go back to the classroom and continue to avoid talking about the real estate of my students’ stories! I’m always trying to eradicate this language.

Whitney Terrell: Units of happiness aren’t real, but they’re really important in economic theory, as Carolin was saying. Character arcs aren’t real either, and we talk about those all the time. They’re an integral part of how a novel is made.

CB: Wai Chee Dimock has a really beautiful essay on The Rise of Silas Lapham—a 19th-century realist novel—and she opens it with this meditation of, isn’t every novelist an economist in the sense that they have to allocate and decide what resources in the book are going to go to whom, and even just the resource of how much space do you give this character versus this character. So I highly recommend that essay.

VVG: We’ll put it in our show notes.

WT: Absolutely. All right, so let’s say I’m a person who does not watch CNBC, or God forbid, Fox Business, where the “Money Honey” reigns supreme. Do you know who that is?

CB: I do not.

WT: They’re talking about Maria Bartiromo. Trump shows up on her show all the time, and people call her the “Money Honey.” I’m not making this up. This is not my sexist terminology. I’m sorry.

CB: It is funny though.

WT: It is funny… Or read the Wall Street Journal. I don’t have a Robinhood account. (I have a Charles Schwab account.) I could care less about the stock market. Imagine that I’m a person who doesn’t have any of these things. Other than this terror that the stock market has for rising wages, which are good for most people, what other kinds of economic stories are equally deceptive? How can I learn to read economists better?

CB: I’m kind of like that. I don’t have a Robinhood account, although I briefly thought about it when GameStop happened. But I think the most important thing is to remember that whenever economists tell you something, even though it sounds very authoritative, they’re not talking to you about physical facts of nature. They’re telling you their interpretation of relationships between humans, social relationships. And that means that whenever they say something, that also can have an impact on how these relationships change. And I’m saying this because that simple fact—the very idea that someone like an economist tells you, here’s what the economy looks like, and I’m using all these fancy terms, and it’s gonna be really hard for you to follow—that’s the thing that turns people off from it. That’s the reason that very smart people will not start studying economics while they’re in college, and it breaks my heart because we need much more of the people in economics I think to make it better. I don’t have anything against the studies, and even some of the stories that I don’t agree with. I don’t have anything against them. My problem is that some of them are too powerful. And I just wish that more people would come to economics who would question that and who will tell other stories.

WT: I want to just shout out briefly—UMKC where I teach has a heterodox economics department and Stephanie Kelton was a member of this department up until recently. So we have some familiarity with that here. Now, you said you don’t want to make predictions. But I do want to know, we’re talking about the Biden boom, is it going to happen or not?

CB: I think there’s gonna be a boom, I honestly don’t think it’s going to be because of Biden, I think it’s going to be because now there’s a vaccine. A boom can only exist because there was a bust. And last year was a huge bust. So there is going to be a boom, anything happening now directly afterwards is going to feel like a boom.

*

Part 2

With Sanjena Sathian

V.V. Ganeshananthan: In this episode, we’re talking about the literature of boom times. And this book has a few timelines, we see in your prologue, the Indian childhood of Anita’s mother, and how she gets the recipe for that ambitious cocktail. There’s a part set in Georgia, where you’re from, in 2005, and Neil and Anita are in high school and seeking academic acceptance, among other kinds. And a second section set in California in 2016, where the business and tech sectors are very active, and money is flowing freely. And in between those two more contemporary timelines, we have, of course, the 2008 crash. And I was curious about, when you started writing the book, what the economic environment was like, and how you think about the relationship between the economy in which you were writing and the histories your characters were living?

Sanjena Sathian: I think the ways in which my novel is a novel about money or the economy, it’s sort of incidental downstream stuff. Like the context that the book takes place in—there’s 2006 suburban Georgia when my characters are teenagers, so they don’t really have any language for what’s going on around them. But what’s going on around them is they’re second generation teenagers growing up in the suburbs, and that creates a very specific middle to upper middle class striving context. And then the second half takes place in 2016 Silicon Valley, where people are starting to have a little bit more language for—maybe there’s something eerie or off about where this upward mobility that they have achieved has brought them. They’re in the middle of a so-called “tech boom,” and what is the potential downside or dark side of that tech boom.

So I was drawing on two periods that I lived through, in Georgia and California, when I started writing this in about 2017. And I was interested in the community that I come from, the movement that we had. A lot of people in the world that I grew up in were middle class scrimpers and savers in these cookie cutter subdivisions when I was growing up. And then I looked up and 10 years later, there was something more like excess. People had gotten fancy six-figure jobs, and were taking for granted a power that I think their parents had hoped for them to have. And I was personally disturbed by what it meant for all this striving to deliver us to this position that felt like a complicity with excess. And so the novel is concerned with that moment, in which I was writing, 2017 to 2019, when the world was starting to see what was wrong with having these billionaire robber barons of the tech world take over.

VVG: One of the nice complexities of the socio-economic striations in the earlier version of the community [in your novel] in 2005, is that Anita’s mother Anjali runs a catering business. And so sometimes there’s this subtle class division and snobbery in the way that the others speak about her. And also, her job puts her in other Indian Americans’ homes in a way that makes it possible for her to steal things, and then also sets her apart in some ways from the others in that community. And there is this sort of desire for excess. There’s 2017 to 2019. And then, of course, the horrid 2020 and 2021, where we do see this excess, these billionaires who are raking it in, and more and more people slipping into poverty, people losing jobs. What has it been like for this book that you wrote about this moment of excess to come out now?

SS: It’s interesting, because I think that people have more vocabulary, particularly for the second half of the book set in Silicon Valley, than they did even when I was writing it. I think that people thought of Silicon Valley as this weird, quirky place where people rode around on hoverboards and were interested in building robots. But it wasn’t that menacing when I moved out there in 2013. There wasn’t cultural vocabulary for how dangerous that place actually is. And then I think there were turning points, like the election when people started to realize that Facebook was not a morally neutral platform. And then over the last four years, as we started to realize maybe there’s something wrong with the fact that you can be a billionaire in Silicon Valley who’s completely insulated from a moment like this one today. So I definitely didn’t write it with sort of sociological intent—I don’t think any novelist ever writes that way. But I think there’s been more social and cultural vocabulary for people to be in communication with the stuff that’s there in the second half of the book. And I think that people understand the implicit critiques that that half of the book makes.

Whitney Terrell: Your book also references The Great Gatsby, which is one of the classic boom novels of American literature, and everyone is familiar with it. I have my own critiques of that book, but it’s a book that’s worth referencing in this category. It came out in 1925. It was supposed to be set in 1922. So it was written during the boom, and yet it wasn’t popular when it came out, it didn’t do well after the crash of ’29. People were like, ‘who’s this asshole writing about rich people? Nobody cares about him anymore.’ And it wasn’t until after the Second World War really that that book became popular. But I wondered if you could talk about how you thought about The Great Gatsby and what you view as the relationship between your novel and that book.

SS: Gatsby is in there, because it’s the book you read when you’re in 10th grade, and my characters are in 10th grade. For me, Gatsby was a novel that introduced me to some core concepts of American literature. So it’s just in my bloodstream in a way. It might not have hit every student the same way it hit me. I didn’t get America when I was growing up. And then someone handed me The Great Gatsby in 10th grade English, and was like, hey, this is this thing called the American dream, and all of the American artists are obsessed with this idea, and all of American politics is oriented around this fiction. And things clicked for me around that.

WT: The fiction of “making it big,” the green light at the end of the dock, is that what you’re talking about here?

SS: Yeah. The Great Gatsby is a novel of economic excess, but it’s also a novel of the falseness of lust and love is a thing that can remake you.

WT: And reinvention. I mean, your characters are reinventing themselves through this potion and Jay Gatsby is not the person that he says that he is. So there’s this element of falseness about making it to the top that I find common in between the two books.

SS: Yeah, definitely. But also there’s a conflation in both books between ambition and lust and love, and greed itself. Nick Carraway spends that novel being fascinated by rich people, which is how F. Scott Fitzgerald was—he went off to Princeton and felt like he was this Midwestern outsider, and fell in love with wealth. And so Neil has critiques of power, but he also is consumed with a lust for power. That dance in the narration is something that I’ve always found interesting in the great narrators of American literature. It’s there in All the King’s Men, too, which is actually the kind of structural corollary for this book. The narrator, Jack Burden, has criticisms to level against Southern politics, but he’s also deeply involved in the power machine of Southern politics.

__________________________________

Transcribed by https://otter.ai. Condensed and edited by Andrea Tudhope. Photo of Sanjena Sathian by Tony Tulathimutte.

Fiction Non Fiction

Hosted by Whitney Terrell and V.V. Ganeshananthan, Fiction/Non/Fiction interprets current events through the lens of literature, and features conversations with writers of all stripes, from novelists and poets to journalists and essayists.