The Great (Un)Equalizer: How Black and Native Families Struggle to Achieve Social Mobility Through Education

Eve L. Ewing on the Structural Factors Behind Economic and Educational Inequality in America

For many people—perhaps including you!—the answer is clear: education provides a pathway toward economic opportunity. More schooling, more money, better life chances. Simple enough equation.

But is education, as Horace Mann famously declared, the great equalizer? If the United States is, as we know it to be, a nation with a deep chasm between haves and have-nots, do schools play a role in smoothing that divide and allowing everyone the same access to wealth? If schooling does indeed pay dividends, does it do so equally for everybody—including for Black and Native people?

The problem is, in the United States, wealth inequality is a feature, not a bug. At its foundations, there is no American capitalism without slavery and settler colonialism. The accrual of wealth through capitalism was never meant for Black and Native people’s participation, any more than cattle can “participate” in the work of a slaughterhouse. Rather, at the origins of the United States, capitalism held roles for Black and Native people that were purely extractive: Taking bodies. Taking babies. Taking land. While cheerleaders striving for an “inclusive” capitalist system can herald individual successes, we have to judge a system by its averages, not by its exceptions—those who happen to stand out as great athletes, artists, or entrepreneurs.

To truly understand economic inequality, we have to think about gaps in wealth—the assets a person has in the form of not only their income but their savings, home, and other things of material value.

One important way to understand the average outcomes of Black and Native people under capitalism is by looking at wealth. In their landmark book From Here to Equality, William A. Darity Jr. and A. Kirsten Mullen make a powerful case for why they consider wealth to be “the best single indicator of the cumulative impact of white racism over time.” Wealth, they argue, has a unique ability to confer advantage and buffer hardships:

Wealthier families are far better positioned to finance elite independent school and college, access capital to start a business, finance expensive medical procedures, reside in higher amenity neighborhoods, exert political influence through campaign financing, purchase better counsel if confronted with an expensive legal system, leave a bequest, and/or withstand financial hardship resulting from any number of emergencies….Wealth provides financial agency over one’s life.

The typical white family possesses eight times the wealth of the typical Black family. Casual observers are quick to offer simple pathways to closing the wealth gap, often rooted in the need for Black people to change their behavior: “get it together,” save more, create different family structures, or value school more highly. But exactly zero of these theories is borne out by the evidence. Black people don’t actually save proportionally less than white families; being in a home with two married parents does not close the racial wealth gap; and studies consistently show that Black people highly value education—and invest in it accordingly.

But, tragically, those investments don’t pay off equally across racial boundaries. White college students are more likely to have their college education paid for by grandparents or parents, and they receive more money: On average, white households contribute $73,500 to their children’s college education. Black parents are less likely to have anything to contribute, and they pay just over $16,000 on average toward college costs.

And after graduation? White families where the head of household has an undergraduate or postgraduate degree hold, at the median, over three times as much wealth as Black households with the same level of educational attainment; in fact a typical Black household headed by someone with a bachelor’s degree has less wealth than a white family headed by someone who didn’t finish high school. Breaking it down by gender makes the disparity even more stark: Among those between the ages of twenty and twenty-nine, single white women with no bachelor’s degree have a median wealth of $2,000. Single Black women with a bachelor’s degree have a median net worth of negative $11,000. They’re in the red.

How can this be? How can education, supposedly an equal-access pathway to a prosperous life, fail so spectacularly to level the playing field?

One explanation is employment discrimination. In one study, a group of sociologists sent a group of 340 young men of different racial backgrounds to apply for real entry-level jobs across New York City, armed with fictional resumes reporting identical levels of education and work experience. They were even matched on other traits, such as their level of eye contact and the way they dressed. The Black study participants were half as likely as white participants with equal qualifications to hear back with an offer.

When some of the role-players were given resumes that noted a criminal background, 17 percent of the white men with a criminal record got a callback, while 13 percent of the Black men without a criminal record got one. Other “audit studies”—where researchers carefully craft a pretend applicant and send them out into the world, thus controlling for factors such as disparate levels of education or personal connections—have found that when all applicants have degrees from the same elite institutions, those with “Black-sounding” names on their resumes are less likely to get a callback.

There’s more to the story. Employment discrimination impacts a person’s income—how much money they take home in their paycheck every month. But to truly understand economic inequality, we have to think about gaps in wealth—the assets a person has in the form of not only their income but their savings, home, and other things of material value, as well as the amount of debt they’ve accrued. And we have to think not only about how that one person is faring, but about how things are likely to pan out for their kids and grandkids.

To understand these disparities, consider the findings of economist Raj Chetty and his team, who have analyzed census records and anonymous tax data following the life outcomes of over twenty million Americans. They traced these individuals’ fortunes from childhood through adulthood to understand their likelihood of climbing the economic ladder and fulfilling the American Dream of ending up better off than their parents’ generation. Chetty’s research documents that intergenerational mobility in the United States has been stagnant for decades, that most Americans fare roughly the same economically as their parents, and that different regions have different average rates of economic mobility; the South, where the majority of Black Americans live, has comparatively worse levels of economic mobility.

When focusing their analysis on the specific outcomes of different racial groups, Chetty and his team have revealed even more striking findings: Black and Native children have much lower rates of upward mobility than children of other racial/ethnic groups. The authors note that while other people of color may have lower income, their rate of upward mobility is comparable to that of white Americans, meaning that over time these income disparities are on track to shrink. To make matters worse, Black and Native kids have much higher rates of downward mobility than children from other racial/ethnic groups, meaning they are more likely to fare worse economically than their parents.

We can imagine these statistics as applied to a group of cars on a track. A car with a white family is zooming around at speed, and the driver has their foot on the accelerator so that their speed is increasing as time passes. The car with the average Latine family is moving at a slower speed, but they are accelerating, such that they will just about catch up with the white family eventually. The cars with the Black and Native families, meanwhile, are broken. They are moving at a low speed…and the gas pedal isn’t working. They’re not accelerating and, if these patterns continue, are not likely to catch up. And some of the cars are actually slowly braking, decreasing in speed and acceleration.

“Reducing racial disparities,” Chetty and his team write, “will require reducing intergenerational gaps—that is, disparities in children’s outcomes conditional on parental income—for blacks and American Indians. Transient programs that do not affect intergenerational mobility, such as temporary cash transfers, are insufficient to reduce disparities because income distributions will eventually revert back to their steady states.” Giving the car a temporary boost in speed won’t work—if you don’t fix the accelerator, eventually it will fall behind again while everyone else is pulling away.

“Okay,” you’re thinking, “cool metaphor. How does this actually work in real life?” When we talk about accruing wealth in America, we often assume that the metaphorical gas pedal is related to things we control as individuals, including how you do in school. But it turns out there’s a huge factor in wealth accrual that doesn’t have much to do with any choice you make. And that factor is intergenerational wealth transfer. If your parents or your parents’ parents have plenty to pass your way—a house or a down payment for one, contributions to your education, or a straight cash inheritance—good for you! If they do not have those things, your lot in life is likely to look rather different.

We might assume that intergenerational wealth transfer makes a difference only at the margin. Surely, you’d think, inheriting some cash might be a nice bonus for some people, but most of how you do in life is based on your effort. But it makes a much bigger difference than you might think. One analysis of wealth transfers conducted by the Federal Reserve estimated that the share of an individual’s wealth attributable to intergenerational transfers is just over half. And intergenerational wealth transfer can take several forms. Inheriting money when someone in your family passes away is one obvious example.

One study, based on data from the 1990s, found that about one in four white families received money this way—about $145,000 on average. One in twenty Black families did the same, receiving about $42,000 on average. Intergenerational wealth transfer can also come in the form of gifts and financial support from living relatives, a common practice at all income levels. Most people, whether rich or poor, help their family members out. But there’s a big difference between “help” that comes in the form of a small loan for a car repair or assistance with school supplies and “help” that looks like a car, condo, or college degree. (Never mind that, for some people, help flows the other way— from children to parents.)

Sociologist Thomas Shapiro has carefully documented how this plays out in practice for different groups of people. Shapiro set out to talk to many kinds of families—solidly middle-class folks as well as low-income folks across the country—and gather intimate stories about the ways that intergenerational wealth transfer has made a difference in their lives. As he points out, those who receive large-scale intergenerational wealth transfers don’t just have more cash to spend on daily bills or fun leisure activities; they are often able to leverage these transfers into major life-transforming outcomes. When asked about parental contributions, one mother Shapiro interviewed, Briggette, rattled off examples, including those that had an impact on her children’s education:

They’ve given us money for the down payment on the house….My parents paid the tuition for my daughter’s school, because it’s the Catholic school and they just wanted her to be educated for that. Let’s see. Yeah, you name it, we get it. They paid our mortgage payment for two months, before my husband found his other job. They have set up trust funds for my children, for each of my children; so that when it’s time for them to go to college, they will have money to do so.

Another interviewee, Shauna, invested the money she received when her parents passed away. She described the many ways it was useful to her and her husband as they tried to provide a high quality of life for their children:

And we did use some to move during law school….We’ve used some to buy a computer. And I used some [for] one small school loan: two thousand dollars. And I paid that off. And I put a little money down on the car. I bought a baby crib, which was four hundred dollars. I took a trip to Russia. Oh, I cannot tell you how much peace it gives me, just to know that if something happened….And that is my security blanket, because I have—you know, I have investments.

Because Shauna has invested her inheritance—in education, in her child, and in interest-accruing financial accounts—it can continue to grow in value, serving as a “security blanket” for her. Having these savings for retirement rather than as an emergency rainy-day fund puts Shauna at an economic advantage. People of color generally have less retirement savings to draw on than white households to supplement their Social Security income.

As for those Social Security benefits, they are tied to your earnings from eligible work over the course of your life. This means that people who earn less income or earn their income from ineligible or unrecognized forms of work (i.e., via the gig economy or work done for cash in the informal economy) receive less to live on in their senior years. One analysis of over two million households found that white recipients of Social Security reported receiving $9,800 annually on average, while Black recipients averaged $7,900 and Native recipients averaged $7,600.

These structural patterns leave all of us making choices about where we live, where we send our children to school, or how we save money within a constrained set of circumstances.

Briggette’s decision to buy a house mirrors the choice of countless Americans who have been told that investing in property is the path to prosperity both for you and for your children. For Black people, though, this gambit doesn’t always pan out. The mere presence of Black people has long been seen as an unspoken proxy for poor neighborhood quality, leading to the widespread devaluation of homes in majority-Black neighborhoods.

One national analysis found that even when comparing homes of similar quality in neighborhoods with similar amenities, houses in majority-Black neighborhoods were valued at 23 percent less, amounting to over $150 billion in cumulative lost value for those homeowners. Nathan Connolly and Shani Mott, married Black professors, made national headlines in 2022 for this telling story: An appraiser and mortgage lender valued their home at $472,000. The couple then recruited a white colleague to pretend it was his home, borrowed family photos from white friends to hang on the walls, and removed all the books by Black authors from their shelves. A second appraiser then magically valued the home at $750,000.

Biases about schools play a critical role in this widespread devaluation, as negative stereotypes about schools and neighborhoods feed one another in a malignant loop. “Good neighborhoods” are understood to be shaped by “good schools,” and Black schools are understood to be bad schools. Researchers have found that both white and Latine parents are more likely to leave public schools for private or magnet schools as the percentage of Black students in their local schools increases.

These structural patterns leave all of us making choices about where we live, where we send our children to school, or how we save money within a constrained set of circumstances—except that we can’t always see the constraints, the differences that leave some people in a bind while others move freely through the market. For some of you reading the stories of Shauna and Briggette, the educational dividends emerging from relatives’ financial gifts may sound mundane. Maybe it strikes a chord with ways your own family members have helped you out.

Meanwhile, others of you probably have your mouths hanging open right now. That’s because, as legal scholar Dorothy A. Brown has pointed out, those for whom inheritances are a casual part of life rarely talk about them openly. In her research, white interviewees “downplayed the inheritances and gifts they received, or the significance of graduating from college without debt because a family member paid their way.” Shapiro echoed this observation in his research on families who’d received significant intergenerational wealth transfers. Even after listing all the many forms of inheritance that have shaped their lives, almost within the same breath they would reassure him that they had in fact worked for everything they have, describing themselves “as self-made, conveniently forgetting that they inherited much of what they own.”

These families probably don’t mean to be hypocritical; they simply don’t see the contradiction between the hard-work narrative and the fact that, as Shapiro puts it, “what a family inherits cannot be earned.” Their cognitive dissonance likely emerges from the fact that moral goodness and educational success are equated with hard, laborious effort. To be a good person is to work, and to accumulate wealth through that work. To be poor is to be lazy, and to be lazy is to be immoral. (Never mind disabled people, people who perform other forms of non-earning labor such as family care work, or people who simply believe that resting is just fine.)

As Brown notes, because these transfers within families are a well-kept secret, poorer families may not realize the extent of their prevalence, while wealthier families may simply assume that everyone enjoys such benefits, leading them to vastly underestimate how wide the racial wealth gap really is.25 One group of social psychologists found that when they asked respondents to estimate how big the wealth gap was in 1963 and in 2016, they were off by 40 points and a whopping 80 points, respectively.

Of course, the patterns Shapiro and Brown have documented may not describe every individual’s life story. A Black or Native person might have extraordinary success and thrive economically, growing their wealth and surpassing the fortunes of their parents. A white individual might have hard luck and real struggle, falling on hard times and slipping to a lower rung on the economic ladder than their parents. I certainly know there are examples of both happening amid my family and friends.

But again, when we’re thinking about how society works, we have to look at trends, patterns, averages over time for the majority of people, rather than focus on exceptional anecdotal circumstances. “I do not begrudge an average family inheritance,” writes Shapiro, “but I am concerned about how weakened public commitments to children, families, schools, and communities encourage people to use inheritances for private advantage.” And what does it mean if schools, the alleged great equalizer, are doing little to even the odds?

__________________________________

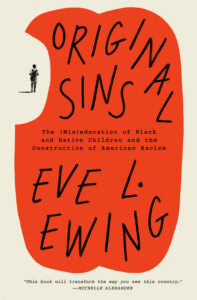

From the book Original Sins: The (Mis)education of Black and Native Children and the Construction of American Racism by Eve L. Ewing. Copyright © 2025 by Eve L. Ewing. Published by One World, an imprint of Random House, a division of Penguin Random House LLC. All rights reserved.

Eve L. Ewing

Eve L. Ewing is a writer, scholar, and cultural organizer from Chicago. She is the award-winning author of four books: Electric Arches, 1919, Ghosts in the Schoolyard, and Maya and the Robot. She is the co-author (with Nate Marshall) of the play No Blue Memories: The Life of Gwendolyn Brooks and has written several projects for Marvel Comics. Ewing is an associate professor in the Department of Race, Diaspora, and Indigeneity at the University of Chicago. Her work has been published in The New Yorker, The Atlantic, The New York Times, and many other venues.