Managing Director of Private Markets Office

July 13 (unscheduled)

“Can you interview her, please?” Emily asked, still standing.

“Interview her for what? The intern of the year award? Do we have an intern of the year award?”

Emily didn’t smile. Normally, he could make Emily smile.

“I would say we need more permanent horsepower on the team.”

“Then should we get a permanent horse.”

Emily was the managing director of private markets. He was the chief investment officer.

“Why are you resisting?”

“Did I ever tell you what John Bogle once told me?”

“You have more than once told me what John Bogle once told you.” Emily smiled this time. As she always did, she immediately covered her gums, biting her upper lip.

The CIO looked closely at her, hopefully without being noticed. After five years, he had never figured out if that gum shame was self-consciousness or a strategy not to leaven an office with too many smiles.

“Ah,” the CIO said, “today apparently marks the day when I officially run out of material. Maybe that’s—” He didn’t finish. He didn’t want to talk about their—his—performance today. He didn’t want to know what Emily was hinting at with what more horses could do.

“Why don’t you want to interview her?”

“Because what kind of recent graduate is still hanging around campus, looking for jobs, in June? The endowment is not the University Department of Post-Graduation Fallback Plans.”

“There’s an explanation for—”

“There’s always an explanation for everything,” the CIO said, maybe talking about the intern.

Emily dressed more Business Person than he did, or was necessary on campus. She smoothed her navy skirt. The CIO checked his own khakis for any stains that were obviously recent.

“I would say that we need more people,” she insisted again.

“Is that true? Does Michael Hermann have more people? I think he trades from a cave in Bhutan, with a single goat by his side. And not even a particularly smart goat that provides excessive goat-power.”

“Then I would say that you should reach out to learn the investment secrets of Michael Hermann.”

The CIO felt a genuine laugh bubble up, warming from his lower belly. He was glad to see Emily laugh, too. She covered her gums.

He was going to joke again, about goats. But then suddenly the laughs smelled stale. Couldn’t the art and science of investing on this campus go a week without the thought—the concept—of Michael Hermann?

Who had nothing to do with anything on this campus. Emily said, “Please just interview her.”

“As always, Emily, I will do as am I told. But just not today.”

Intern interview Office

July 14

“Does that apply to late capitalism, too?” the intern asked.

The CIO liked her, even if he had no idea why any of them thought that this was the best use of their open sky. “Is that what we’re living in? Late capitalism?” he repeated, chuckling, a benign uncle. “Like, socialism, communism, capitalism, and mercantilism were told it was time for dinner, and capitalism showed up at 7:15 and missed the soup?” Her eyes had begun to dew. They were walnut brown, larger than her face needed them to be. He stared at her skin, trying to measure what made youth. “It was a joke. I assumed that you had already learned that there is an 80 percent chance that what comes out of my mouth is a joke.”

“I’m sorry.”

“You don’t have to apologize. That is not your personality trait. That is my personality trait. Maybe you face the facts head-on, without the need for irony. For which you should consider yourself lucky.”

She stared at him, the fact head-on, without a need for anything. The CIO should save this mask (if that’s what it was anymore) for the hedge fund and private equity guys pitching them. He tried again, head still on. “Tell me again why you want to remain here to embark upon a career in endowment management?” “I was really engaged by the projects I worked on during my internship. Figuring out whether a manager’s track record was good or not was like, um… endlessly fascinating.”

“Can I ask another question?” He tried not to mimic her uptalk.

Maybe he had succeeded. “Did you apply for jobs elsewhere?”

“Sorry?”

They both knew it had been two weeks since graduation. “Did you go to New York to let twenty-five-year-olds from Morgan Stanley ask you why manhole covers are round or to guesstimate the number of laundromats in Pittsburgh?”

She smiled, almost easily. “I’m not really interested in moving to New York.“

“Well, at least you were spared that experience. Maybe they are trick questions. Maybe there are no longer laundromats in Pittsburgh. And five hundred of your classmates are probably already in that channel of the meritocracy. Was there any interest in trying the other Golden Pole, seeing what life is like at a startup? One—I don’t know—using artificial intelligence to optimize burrata?”

“I’m not—”

“That was a San Francisco joke. Apparently not the best one. I thought it was pretty… Anyway, the purpose of the internship program is partly educational but also instrumental. To help people get jobs. Out there. Off campus. Not that this isn’t also out there, I guess.”

He rolled his fingers into fists and heard his knuckles crack. He had to release the not quite completed grip.

“I’m sorry.”

“Again, please don’t apologize. You didn’t do anything wrong. Maybe it’s my fault. A couple of years after I took over as CIO, Jim Pascarella, one of our trustees, kept asking me if we could improve our performance by moving to New York. I tried not to take it personally. These khakis may not be the most intimidating pants, but our numbers were pretty good even without being more snazzily panted. The fact is that we are one of the last—maybe the last, other than Stanford—large endowments to be located on campus. Christ, Dartmouth has moved out of state. Before you were born, a few endowments came up with the idea that, to succeed, you had to hire real Wall Street types, and those dudes belonged in the high floors of skyscrapers, where the weakened gravitational pull required suspenders.”

Nothing. Part of him wanted to let her stay if she really wanted to stay. Her sleeveless, eye color-matching dress was not quite casual but was also not formal, like Emily’s outfits. He continued, “Those type of guys are super unpopular now at endowments— maybe everywhere. I’m grateful for that. You really don’t want to see a guy in khakis with suspenders unless he is threshing wheat. But even nowadays, if you want classic LP types—that’s limited partner—the conventional wisdom is that it’s hard to hire a team if they have to live among the gothic towers and particle physicists. I accept the social reality at some of our bigger brother—sister?— endowments, in which the ‘managing director of real assets’ is paid three times the best particle physicist. It’s awkward to make eye contact when that fact becomes known. But I thought, screw it: if you work here, you have to make eye contact with particle physicists—if particle physicists are capable of making eye contact—because this is not some theoretical pool of capital we are managing. This is not particle physics.”

The CIO smiled, for himself. “I want everyone to come in here every day and see what we are tasked with: last year, providing 264 million dollars to everything that goes on outside there.” He hitchhiked his thumb to the quiet summer quad behind him. “That’s 264 million, with the understanding that it better be 300 and then 400 million within five to ten years. I know that’s an incredible amount of money—we’re not running Microsoft here— but the university’s operating expenses are three times that. And we cannot—I repeat, cannot—fail to provide that money. I’ll get off my high horse before I start talking about the advancement of ‘human thought and human character.’”

For a year after the Times article came out, he could give himself goosebumps with his words’ easy nobility. But even last year it wouldn’t have grabbed him so hard, how—why—he’d turned out on the funding side, rather than the receiving side, of human thought and human character.

And human? Versus monkey thought and beaver character? “So anyway,” he went on, “scholarships are expensive, art history is expensive, particle physicists are expensive. Their particles are really expensive, you have no idea.”

No reaction from her. He could feel his own attempted smile coming out crooked.

“Again, a joke. I have no idea how expensive particles are. You’d imagine that they are not terribly expensive. They are, after all, particles.” He pointed to the air. “I think that one is, like, only six bucks. The point I am trying to make, with the non-joking 20 percent part of my communicating ability, is that, unlike our endowment peers in New York or Boston or wherever, I don’t want our office to be merely decorated with coffee table books—Our College: Its Whiter Days—gathering mold in the waiting room.” He wondered if Emily, who was Black, would find that funny, unlike the intern, who was very much not? “I figure the trade-offs of awkward encounters are worth it to have us in this university, with the essential purpose of that call on 264 million dollars felt daily.”

She was staring at him. Was she asking for paved routes to meaning, happiness, identity? He swallowed hard and looked down at his pants.

He had taken only this route. He had been taken only on this route.

He rubbed his hand hard over his eyes, clearing them, before dragging it over his closely trimmed beard.

“But I should be asking you questions. Wall Street’s greatest product, as you may have already learned, is lectures on the way the world really works. Fifty percent of our job is listening semi-patiently to GPs—general partners, the asset managers—lecture us on how they have conquered fear, greed, and uncertainty in the more accurate prediction of the future. Not totally believing them is another 25 percent. The hardest 25 percent is figuring out what exactly to not believe. But anyway, back to you, why exactly are you avoiding the bright lights of big cities to work here of all places?”

She pounced: “There are the intellectual aspects to the work, which I find really appealing. And I think a career in finance is important. I learned both in classwork and in my internship how finance, as power, drives so much of the world. But I also need to be passionate about what I do. That’s probably why I never wanted to do investment banking at Morgan Stanley, in addition to not really caring about the laundromat situation in Pittsburgh.”

She smiled, not quite aware of the unnaturalness of her humor. He felt sad for WASPs for not being Jewish. But he also sensed values coming from somewhere planted. She went to a good school. She was a good person.

She continued: “And so I really admire you wanting the endowment to be on campus to be meaningful. That’s really important to me, too: doing well by doing good.”

“There it is,” he said of the phrase, more dismissively than intended. He needed to revive a jocular tone, his 80 percent. He tried to be very clear. “Let me be very clear.” That didn’t exactly—“The conflict of values is unavoidable. Everywhere. We are not in some Neverland here. Although you meet a lot of Lost Boys.” He rubbed his face again. There was anger he needed to pet calm, like a permanent horse.

For once, in one aspect of his life on Earth, he wanted to disprove the lies and hypocrisies that everyone told themselves were purpose.

To be, singularly, the disproof.

So why couldn’t he just explain to this child his disgust at the totalizing nonsense of doing well by doing good? (Could he point to the Lost Boys, who wanted only to do well?) Why couldn’t he start anew, on truthful grounds, for all of them, for his own children: a demonstration of the routes a career took you into yourself?

He didn’t know where to begin. So he began the interview again. “What was your major again?”

“Economics and history.”

“All you kids have double majors nowadays. In my day, we had only single majors. At this rate of change”—the CIO scratched the math out on some paper in front of him, the calming of arithmetic—“by 2080, students will all be octuple majors: economics, history, burrata AI, spaceship repair, apocalypse resilience, robot sociology… and phones. Just ‘Phones,’ sort of like ‘English’ now.”

She looked composed. Or she just looked like what beauty gave you when you were twenty-two.

“Why did you choose those majors?”

“Coming out of high school, I thought I wanted to be an econ major. But after taking U.S. social history freshman year, it became clear that a narrow economics focus wouldn’t allow me to understand structure. And in economics, especially macro, it all seemed so, um, bloodless unless you applied it to the real world.”

The CIO smiled, relieved. Would Hannah grow up to be this thoughtful? Jane told him it was offensive to compare every female college student to a ten-year-old. But would Hannah want to do well by doing good?

“That’s an interesting answer,” he said, leaning back. “I was a history major, too.” When he first landed on campus, he embarrassed himself by sharing that fact with too many faculty. “But even with a half double major, studying human motivation and coming to the best possible conclusions from ambivalent evidence is a good preparation for this work. Which is judgment. Correct judgment. Because that’s our job. We have sixty or so GPs across asset classes. Each GP manages 1 to 4 percent of the endowment. They are all pretty smart in some way or they wouldn’t—or, at least, shouldn’t—have gotten in the door. They are also all, with too few exceptions, the rich white guys that everyone is exhausted by in our quest for Diversity, Equity, and Inclusion. We try to not back the ones that are already too vilifiable. For what is our job? It’s not to judge the GPs as people. It is not to signal our own intelligence.” That wasn’t as accurate as he wanted it to be. “Our job is to judge the GPs’ sometimes brilliance—sometimes actual genius—and know when is the right time to replace one of them because their blind-spotted brilliance isn’t translating into our task of providing 264 million dollars to this educational institution.

“And we can replace them. There is an endless supply of asset management firms desperate to get some of this endowment to manage. Some of them are hustlers, some of them are creeps, all of them, deep in their hearts, believe it’s their divine right to become billionaires. We are, I hope, mainly dealing with the least creepish cream of the crop. So I doubt these firms will disappoint us by stealing from us. However, I don’t doubt as much as I want to that many of them—maybe most of them—will one day nonetheless disappoint us by being humanly fallible, limited, and leaving too much to luck. But, for now, we have an existing roster of managers. We add a few per year, drop a few per year, and spend a lot of time deciding how we adjust the ingredients—of how much capital each manager, each asset class should get. More salt, more pepper, more paprika—or, Jesus, no paprika at all. I’m making it all sound very interesting.”

She smiled. He looked at her and tried to break a habit of judging by what he saw. Beauty is just symmetry.

“You definitely are,” the intern said. “I got so fascinated by the GPs in my internship. I mean, these are literally the most successful people on earth. Everyone talks about them. People run for president to defeat them. They are the winners in our current social structure, and understanding them better seems—”

“I understand the epiphenomenon—is that the right word?” She nodded.

“The epiphenomenon of finance is interesting,” he continued. “When I was twenty-three, I started working at an investment bank after a year of graduate school. Credit Suisse First Boston: a crazy string of random words, right? And I found everything interesting. The people were funnier and edgier and taller and more alive—the hunters on the plain—than the gatherers of nuts I had just come from. But that was thirty years ago.”

She smiled at him.

“And I still can’t help speculating on why money management is debated by the wannabe leaders of the free world. Is it the amount of money nowadays? Or is it just that people have always been fascinated by the occult power to make money out of money?” The CIO spun up his hands, signaling, sort of, occult. “But if you get nothing else from this interview, if you decide that it is better to bolt to Palo Alto or Austin or wherever the hunters live nowadays and invent something tangible and great, remember what we’re trying to do in this little office: 264 million dollars is not about being a witness to the winners of late capitalism. And it doesn’t care if we are doing good. Two hundred and sixty-four million dollars is about being the responsible party on campus, to keep fed this experiment of intellectual freedom and exchange. Even if the art historians and the scholarship kids don’t know what we do. Even if they hold what we do in contempt. I have neither the time nor the inclination to explain it to a man who rises and sleeps under the blanket of the very freedom that I provide and then questions the manner in which I provide it.”

No reaction.

“Jack Nicholson? A Few Good Men? I got to get newer references.”

Her walnut brown eyes widened, hopeful and never unconfident.

“Emily says you did a good job on the PMD project.” Emily had actually said a touch academic and maybe useless, but it was his duty to guide these kids out of the abstractions of late capitalism. “She also says that, with Edgar off to Makena, we could use the help.”

“Because we had a very bad year?”

They were looking at each other, and yet, somehow, she was avoiding eye contact. He squeezed hard his chin, trying to avoid moving his hand upwards.

Who are the people who get to be the disproof, who are not the lies and hypocrisies we adopt as purpose, who get to lecture us on the realities?

Weren’t those lectures his job, with the x-ray secret talent of a chief investment officer?

He hated—hated—to lie. Not lying is the secret talent of a chief investment officer.

He couldn’t give her the job.

“We did not have a very bad year.”

__________________________________

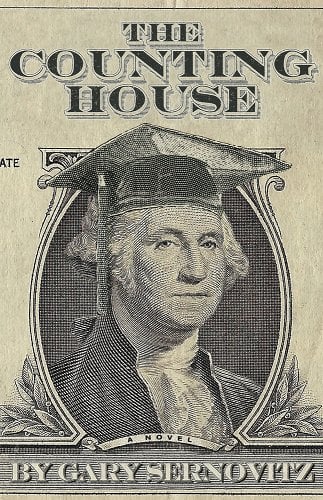

This excerpt of The Counting House by Gary Sernovitz is courtesy of University of New Orleans Press Copyright © 2023 by Gary Sernovitz.