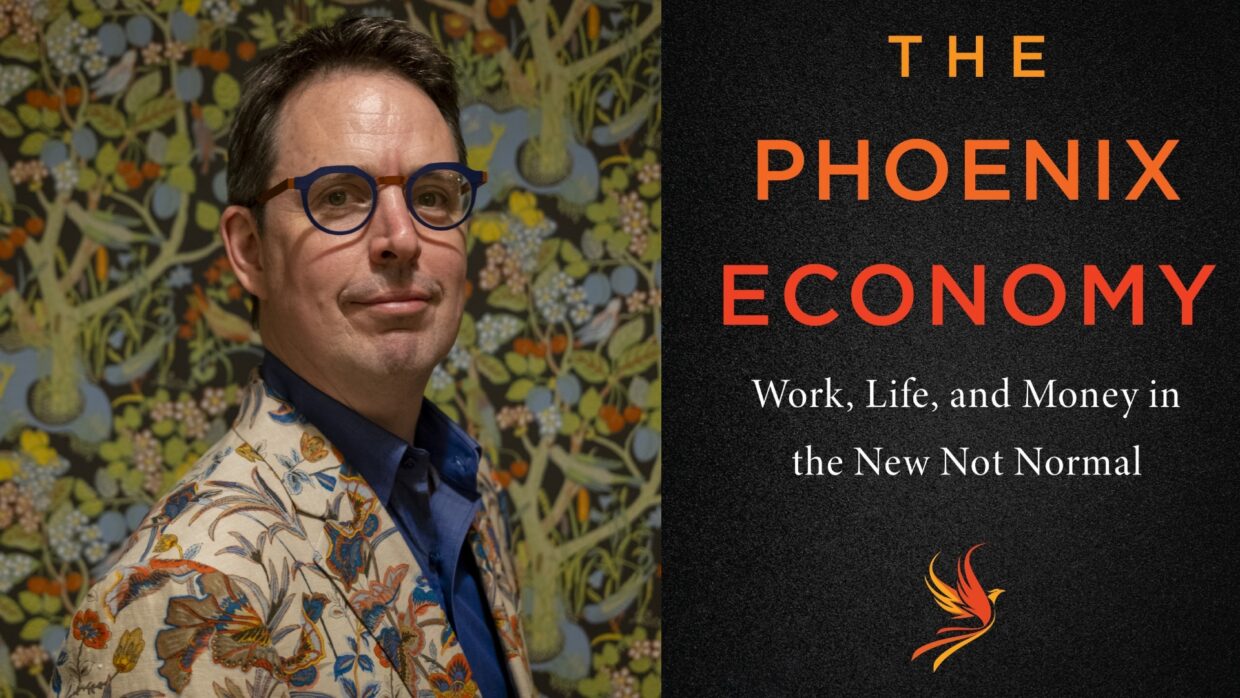

Rising from the Ashes: Felix Salmon on the Debt Ceiling Crisis and the Surprising Resilience of the COVID Economy

Felix Salmon in Conversation with Whitney Terrell and V.V. Ganeshananthan on Fiction/Non/Fiction

Financial correspondent and podcast host Felix Salmon joins co-hosts V.V. Ganeshananthan and Whitney Terrell to discuss the debt ceiling crisis and his new book The Phoenix Economy: Work, Life, and Money in the New Not Normal. Salmon unpacks the political and financial ramifications of our current debt ceiling crisis—and compares the present impasse to prior debt ceiling fights.

He also discusses the underappreciated and unexpected economic effects of the COVID pandemic, including an increase in the financial health of lower income Americans and a redistribution of population away from major cities. Salmon reads from The Phoenix Economy, and explains how the pandemic will continue to change our economic lives.

Check out video excerpts from our interviews at Lit Hub’s Virtual Book Channel, Fiction/Non/Fiction’s YouTube Channel, and our website. This episode of the podcast was produced by Anne Kniggendorf, and edited by Hannah Karau.

*

From the episode:

V.V. Ganeshananthan: I’m a big fan of what you call “this influx of capital into the working classes.” It shows that we can influence economic quality of life in lower income brackets, if we want to. The question is, do we still want to do that? Will this continue in any way? The work requirements that the Republicans want for Medicaid are moving in exactly the opposite direction, it seems to me.

Felix Salmon: So it really kind of depends on how you think about “we.” A lot of these discussions think about “we” as being the government, right? The government writes checks to the poor, and the poor do well, or the government imposes work requirements on the poor, and the poor do less well. The poor are just sitting there as relatively powerless individuals in America. They wind up effectively doing as well or as badly as the U.S. government wants them to do, and the power, it just sits in Washington.

I think what we saw during the pandemic was the rise not only in incomes of the poor, but also in the power of the poor. They found themselves with bargaining power for the first time. The relation between labor and capital started becoming much more even for the first time that, more or less, any of us can remember. The poor started being able to quit their jobs and find better paying new jobs. They started being able to unionize, and they started being able to demand higher wages.

And employers started realizing that they needed to pay people more in order to get them to do work. All of these things happen outside this question of: “should the government impose work requirements on Medicare and things like that?”

So, yes, we can have debates about the government. And obviously, what the government does to the poor is very important, and poverty reduction programs are crucial. But underneath that, what we saw during the pandemic, and I think this is here for this foreseeable future, is actually something more powerful still, in a way, which is that we’ve empowered the working classes to demand better working conditions and better pay.

Whitney Terrell: I love that. I mean, I’m a fan of that. It’s a really remarkable thing because it has been a long time since you’ve seen people be able to bargain for better wages, at least in my anecdotal memory of the last 20 years. There are some issues, though, and I wonder how they’re going to affect that part of it. In the book, you talked about how extremely low interest rates are, which have now changed in the last year because the Federal Reserve has raised rates significantly.

And the other thing that I thought about was immigration. I mean, Trump immediately closed the borders using this law that was associated with influenza and different diseases, saying that you can deny asylum to anyone who might be bringing a disease in the United States. They just stopped doing that. So I wonder, could you talk about those two issues at that level?

FS: I can comment on the immigration process. I think the first thing you need to understand about immigration, and I’ll comment on interest rates in a minute, but the thing you have to understand about immigration is that it’s good for both labor and capital in a weird way. Obviously, companies want new people to do the jobs. We have a major labor shortage in the United States right now, which was caused largely by Covid. A lot of people died, a lot of people got long Covid, and a lot of people just got, you know, a feeling of “YOLO. I don’t like my job, and I’m going to quit it to go and lay on the beach or start my own company.”

So we do have this incredibly low unemployment rate that is causing a labor shortage, and immigration would help alleviate some of that labor shortage. But immigration— and this is something which economists have really studied for decades—at the margin, doesn’t really have any huge effect on wages, but probably brings them up rather than down. The immigrants wind up starting companies and employing people and increasing demand for labor and growing the size of the economy. And most vibrant economies have pretty strong degrees of immigration and the more immigration America has, historically speaking, the better its economy has done and the better off its workers have been. So I think we can be pro-immigration while still wanting more power for the working classes. I think it’s easy to hold both of those two ideas in your head at the same time.

And interest rates are slightly more interesting. You know, the whole point of the Federal Reserve raising interest rates is to cool demand in the economy; they thought that the economy was running too hot. They just wanted companies to slow down a bit and hire fewer people and try to reduce demand for labor, among other things. That will definitely show up in reduced demand for workers in the bottom half of the income distribution, for sure, but one of the weird things is it has shown up, initially, mostly in the top half of the income distribution.

WT: Yeah, that’s what I’ve been noticing, the software engineers are getting laid off.

FS: Exactly. The big layoffs have been in places like Google and Amazon and Facebook, right? They haven’t been in fast food joints. So you know, maybe that’s the way we can reduce demand, by laying off a few software engineers making half a million dollars a year, and they’ll have to find some new job paying $400,000 a year. That could have the same effect.

VVG: This is fascinating. I am curious, and I think we’re probably going to do a whole separate episode about this later, but I’m really curious about your take on how this will fit in—I’ve been reading all of this stuff about efforts in different states to loosen the regulations on labor by minors. And also, of course, there have been some exposes about the exploitation of migrant children for labor. But it seems like two separate things, like both this kind of performative Republican effort to be like, “we want our children to work,” and it’s also an attempt to, in some way, address this labor shortage, that isn’t immigration. I’m just curious what you think about that and what potential impact, if any, it will have.

FS: Right. There’s a whole bunch of very, very separate issues being conflated here. One is that kind of nostalgic Republican idea of like, “I had a paper route when I was a teenager, and it was great for me, and I learned the power of the dollar and the power of hard work, and we should encourage our children to find jobs like that.”

That kind of thing plays well with a certain part of the electorate, and it’s completely unrelated to the other thing that’s happening, which is genuine exploitation of minors who are being forced into work and sometimes not paid at all, who are often migrants who are often undocumented, who are often just being completely exploited. And that is, and always has been, and always should be illegal. It’s not really being enforced super hard in all states. But even if you pass laws, sort of saying we should allow kids to work, like the extreme exploitation of migrants is something that is not going to be made legal and obviously shouldn’t.

WT: All right, so let’s say we default, let’s say they don’t get it put together. Okay. So what would happen? The stock market would crash, I assume. It went down like 19 percent, I think, in 2011 when we got close to it. The bond market would go haywire. Maybe the U.S. would get another S&P downgrade on its debt, which is what happened also in 2011, if I’m remembering right. Or maybe that was an earlier year, you can tell me. Would this really affect people who don’t have large stock and bond holdings? In the book you pointed out that the enforced hibernation of Covid actually had some benefits, right? Is it possible that a debt default and ensuing economic winter would have some of the same benefits? Especially for the working class? We just do the same thing? Oh, yeah, we get more stimulus, everyone stays home. It’ll be good.

FS: Okay. My thesis in the book is that we’re in “the new not normal” and lots of unexpected things happen. And we have to be open to crazy, unexpected events. And I suppose that, in principle, a U.S. government default suddenly being a good thing would be extremely unexpected. I also think it would be incredibly unlikely. There is a lot of doom and gloom being wheeled out in terms of what would happen in the event of default, because we haven’t defaulted really, since 1878.

We don’t really know, so I can’t tell you what would happen. But what I can tell you is that the Treasury Bond market is the bedrock upon which the entire global financial system sits, and those very stable and predictable cash flows in terms of the interest payments on Treasury Bonds coming from the U.S. government and flowing into the entire global financial system is what keeps the global economy moving. Without those flows, everything grinds to an immediate halt. The money doesn’t go where it needs to go.

• The Phoenix Economy: Work, Life, and Money in the New Not Normal • Slate Money podcast

Others:

• “A Brief History of Debt Ceiling Crises” by Raymond Scheppach