200 authors call on Baillie Gifford to divest from Israel and fossil fuels.

Ahead of the UK festival season, more than 200 authors—including Naomi Klein, Sally Rooney, Natalie Diaz, and Robert Macfarlane—have signed a statement by Fossil Free Books (FFB) which puts increased pressure on investment management firm Baillie Gifford, sponsors of the Baillie Gifford Prize for Nonfiction. In addition to the reiteration of its October demands that the company ceases its investments in the fossil fuel industry, the group is asking that Baillie Gifford also divest “from companies that profit from Israeli apartheid, occupation and genocide,” stating that “solidarity with Palestine and climate justice are inextricably linked.”

The statement, released today to coincide with the 76th anniversary of the Palestinian Nakba, is unequivocal about what literary organizations can expect should they continue their relationship with an undivested Baillie Gifford:

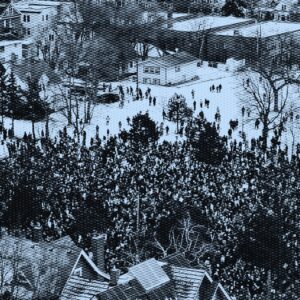

Until the firm agrees to divest, we call on all literary organisations, including festivals, to end their relationships with Baillie Gifford. If our demand is not met, we reaffirm our commitment to take action through disruption and by withdrawing our labour.

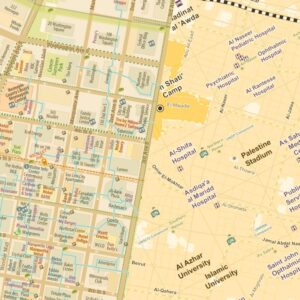

Ten UK festivals (including the Hay Festival, Cheltenham Literature Festival, and Edinburgh International Book festival) are currently sponsored by Baillie Gifford, which has invested almost £10 billion in companies linked to Israel’s defense, tech and cybersecurity industries (making it “a top European investor in companies linked to illegal Israeli settlements”), and between £2.5 and £5 billion in fossil fuel companies like Shell, Pretrobras, and Equinor.

Pressure has been mounting on these festivals for some time now. Last year, over 150 authors and book workers—including Greta Thunberg, Ali Smith, and Gary Younge—signed statements calling on Edinburgh International Book Festival to cut ties with the controversial sponsor unless it divests from the fossil fuel industry. Thunberg ultimately refused to attend the 2023 incarnation of the festival, accusing the sponsor of “greenwashing.” Later in the year, a further 150 authors signed a second statement calling on Cheltenham Literature Festival to demand Baillie Gifford divest from the fossil fuel industry.

“Literary festivals rely on the labour of writers, editors and translators,” said Naomi Klein in response to today’s statement, “We donate our labour because we love to gather and meet our readers, but we have the right to demand that these gatherings divest from the forces causing death and destruction on an unfathomable scale. The literary community must do better.”

In the past seven months, over 35,000 Palestinians have been by Israeli killed in Gaza, including more than 14,500 children and more than 100 writers, poets, and journalists. Every university in Gaza has been destroyed. Cultural sites, archives, printing presses, bookshops, and publishing houses (in both Gaza and the West Bank) have all been targeted by the Israeli army.

[UPDATE]

A Baillie Gifford spokesperson shared the following (abridged) statement in response to this article:

The suggestion that Baillie Gifford is a large investor in the Occupied Palestinian Territories is seriously misleading. It is based on conflating two different types of exposure:

1. We are large investors in several multinational technology companies, such as Amazon, NVIDIA and Meta (our clients have approx. $19bn invested in these three), that have commercial dealings with the state of Israel that are tiny in the context of their overall business. Practically every consumer and investor in the developed world is using the services of these companies.

2. We are also small investors in three companies that have been identified as having either connections to the Israeli state or activities in the occupied territories, namely AirBnB, Booking.com and Cemex (approx. $300m invested in these three). We have been engaging with those companies. This work has been going on since the conflict broke out and in all three cases progress has been made.

. . .

We are not a significant fossil fuel investor. Only 2% of our clients’ money is invested in companies with some business related to fossil fuels. This compares to the market average of 11%. Of those companies, some have already moved most of their business away from fossil fuels, and many are helping to drive the transition to clean energy.

. . .

Dan Sheehan

Dan Sheehan is the author of the novel Restless Souls (Ig Publishing) and Editor-in-Chief of Book Marks.